Which Of The Following Variables Do Not Change Autonomous Consumption?

Basic Macroeconomic Relationships

Earlier developing the Keynesian Aggregate Expenditures model, we must understand the basic macroeconomic relationships that are the components of that model. The components of aggregate expenditures in a closed economy are Consumption, Investment, and Government Spending. Because government spending is determined by a political process and is not dependent on fundamental economical variables, we will focus in this lesson on an explanation of the determinants of consumption and investment.

Section 01: Consumption and Savings

In the simplest model we tin consider, we volition assume that people do one of 2 things with their income: they either consume it or they salvage information technology.

Income = Consumption + Savings

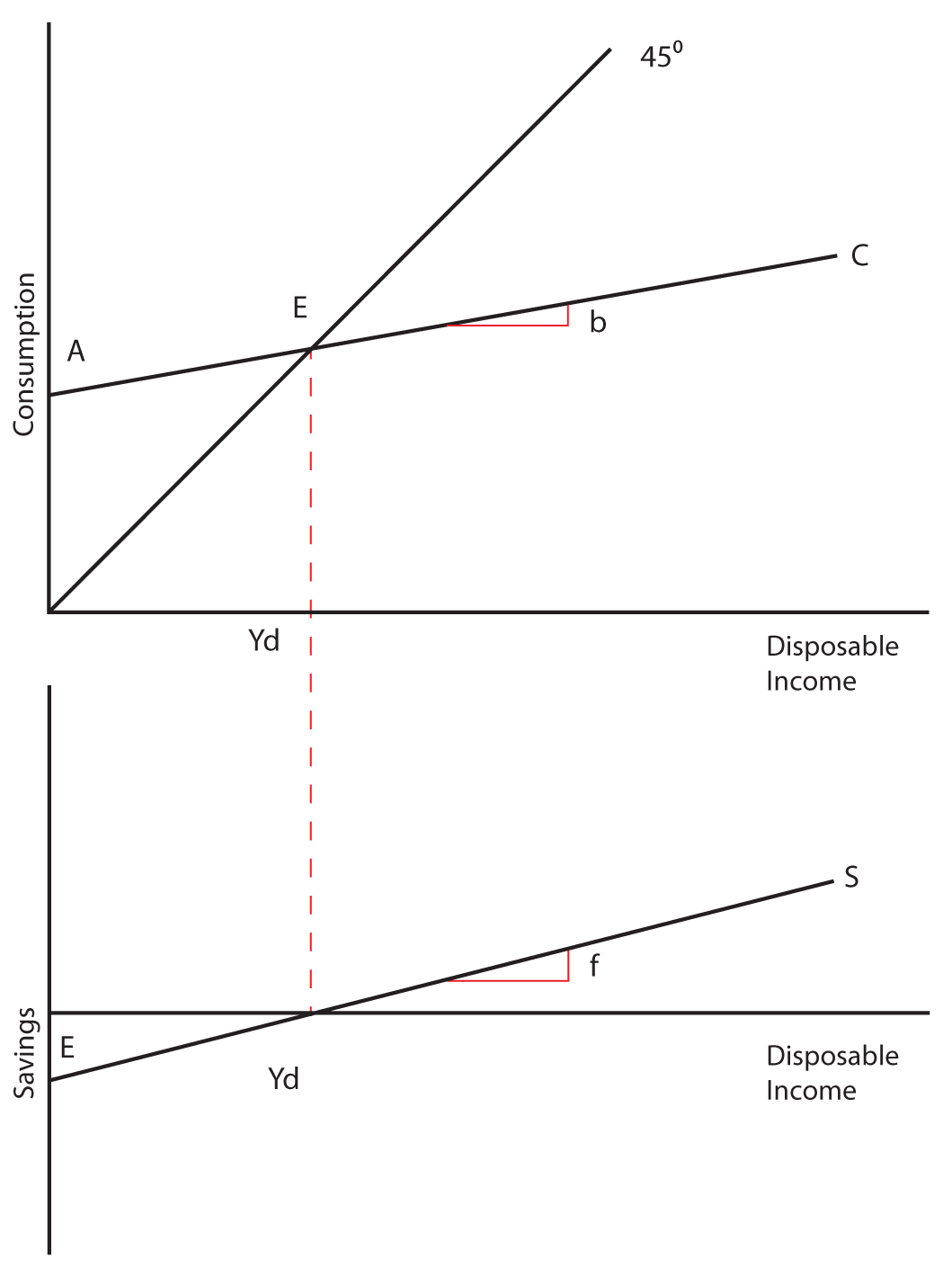

In this simple model, it is easy to meet the relationship between income, consumption, and savings. If income goes up then consumption volition go upwardly and savings will go up. Consider the graph below, which shows Consumption as a positive office of Income:

Notice the apply of the 45˚ degree line to illustrate the bespeak at which income is equal to consumption. At that point, labeled E in our graph, savings is equal to zero. At income levels to the right of point E (like Io), savings is positive because consumption is below income, and at income levels to the left of signal Due east (like I'), savings is negative because consumption is in a higher place income. How tin savings be negative? If you lot thought of borrowing, you are right. In economics we phone call this "dissavings." Point E is chosen the breakeven point because it is the signal where there are no savings but there are also no dissavings. The graph below demonstrates the human relationship between consumption and savings:

The Consumption Function

The Consumption Function shows the relationship betwixt consumption and disposable income. Dispensable income is that portion of your income that you have command over afterwards you have paid your taxes. To simplify our word, we will assume that Consumption is a linear function of Disposable Income, simply as it was graphically shown in a higher place.

C = a + b Yd

In the above equation, "a" is the intercept of the line and b is the slope. Let'south explore their meanings in economics. The intercept is the value of C when Yd is equal to nothing. In other words, what would your consumption be if your dispensable income were zero? Tin there exist consumption without income? People do this all the time. In fact, some of you students may have no income, and yet you are still consuming because of borrowing or transfers of wealth from your parents or others to you. In any example, "a" is the amount of consumption when disposable income is zero and information technology is called "autonomous consumption," or consumption that is independent of disposable income.

In the consumption function, b is called the slope. It represents the expected increment in Consumption that results from a one unit increment in Disposable Income. If Income is measured in dollars, you might ask the question, "How much would your Consumption increase if your Income were increased by ane dollar?" The slope, b, would provide the reply to that question. It is the change in consumption resulting from a change in income. (Remember the idea of a slope being the rise over the run? Go dorsum to the graph of the consumption office and satisfy yourself that the rise is the change in Consumption and the run is the change in Income, and you will come across that this definition of b is consistent with the definition of a gradient.) In economics, "b" is a particularly important variable because it illustrates the concept of the Marginal Propensity to Consume (MPC), which will be discussed below.

The Savings Role shows the human relationship between savings and disposable income. Equally with consumption, we will assume that this relationship is linear:

S = e + f Yd

In this equation the intercept is east, the autonomous level of Savings. With savings, it is quite likely that "due east" will be negative, which indicates that when Disposable Income is zero, Savings on boilerplate are negative. The slope of the savings function is "f," and information technology represents the Marginal Propensity to Save—the increase in Savings that would be expected from any increase in Disposable Income.

Marginal Propensities to Eat and Salve

The Marginal Propensity to Consume is the extra amount that people consume when they receive an extra dollar of income. If in one yr your income goes up by $1,000, your consumption goes upward past $900, and you savings go up by $100, then your MPC = .9 and your MPS = .1. In general it can be said:

MPC = Change in Consumption/Modify in Disposable Income = ∆C/∆Yd

MPS = Change in Savings/Change in Dispensable Income = ∆South/∆Yd

It is besides important to observe that: MPC + MPS = 1

Retrieve, the MPC is the slope of the consumption part and the MPS is the slope of the savings function.

Instance

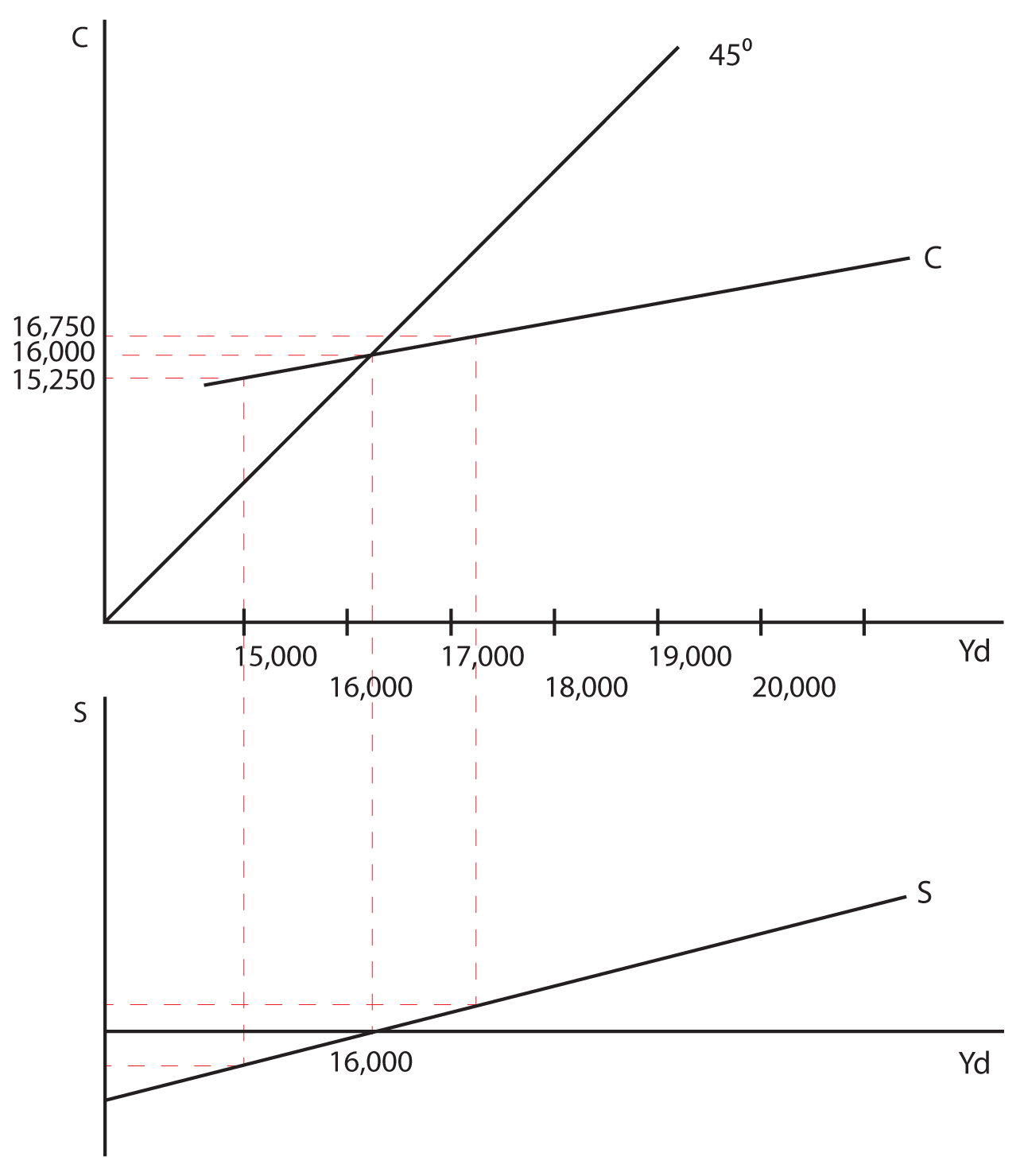

Permit'southward do an example using data for a hypothetical economy. The data is presented in the table below. From this data I will graph both the Consumption Function and the Savings Function and summate the MPC and the MPS. Afterwards going through the example, I will requite you a separate set of data and ask you to do the aforementioned thing!

| Disposable Income | Consumption | MPC | Savings | MPS |

|---|---|---|---|---|

| $xv,000 | $15,250 | 0.75 | -$250 | 0.25 |

| $16,000 | $16,000 | 0.75 | $0 | 0.25 |

| $17,000 | $xvi,750 | 0.75 | $250 | 0.25 |

| $xviii,000 | $17,500 | 0.75 | $500 | 0.25 |

| $xix,000 | $18,250 | 0.75 | $750 | 0.25 |

| $20,000 | $19,000 | 0.75 | $1,000 | 0.25 |

Notice that every bit you lot move from an income of 15,000 to an income of 16,000, consumption goes from fifteen,250 to 16,000 and savings goes from -250 to 0. The MPC and MPS are therefore:

MPC = ∆C/∆Yd = 750/1000 = 0.75

MPS = ∆S/∆Yd = 250/1000 = 0.25

Since the Consumption Function and the Savings Function are both direct lines in this example, and since the slope of a straight line is abiding between whatsoever 2 points on the line, it will be piece of cake for y'all to verify that the MPC and the MPS are the same between any two points on the line. You tin too meet that that MPC + MPS =1 as was stated earlier.

Remember Nigh Information technology: Computing MPC and MPS

Graph the Consumption Function and the Savings Office for the data provided in the table below. Also calculate the MPC and the MPS in this example.

| Disposable Income | Consumption | Savings | MPC | MPS |

|---|---|---|---|---|

| $iv,575 | $four,647 | -$72 | ||

| $four,755 | $four,791 | -$36 | ||

| $4,935 | $iv,935 | $0 | ||

| $5,115 | $5,079 | $36 | ||

| $5,295 | $5,223 | $72 | ||

| $5,475 | $5,367 | $108 | ||

| $5,655 | $five,511 | $144 | ||

| $5,835 | $v,655 | $180 | ||

| $6,015 | $5,799 | $216 | ||

| $6,195 | $5,943 | $252 |

Respond

For each example:

MPC = 0.80

MPS = 0.20

Note that MPS + MCS always equals 1 in this model. Close (X)

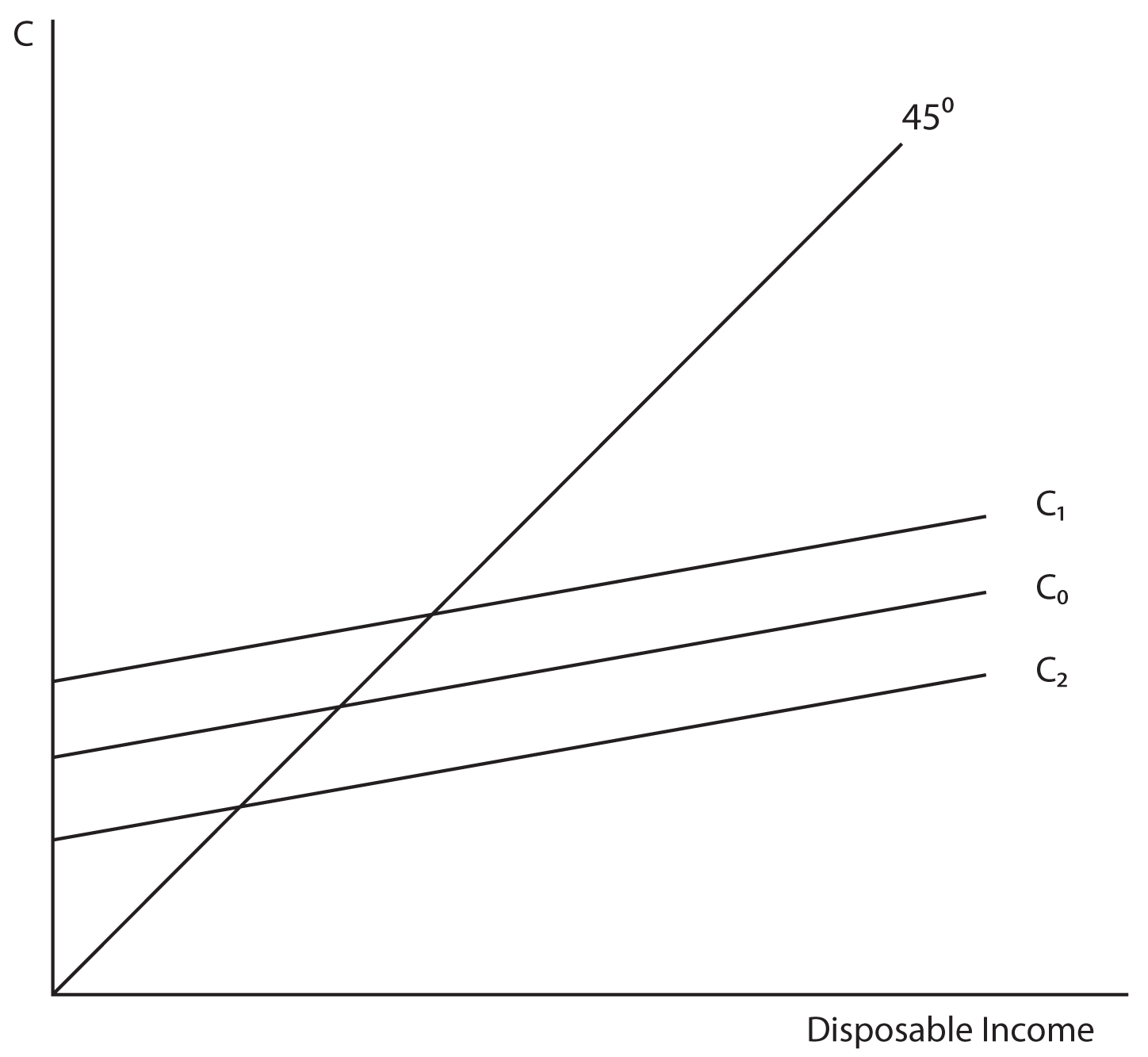

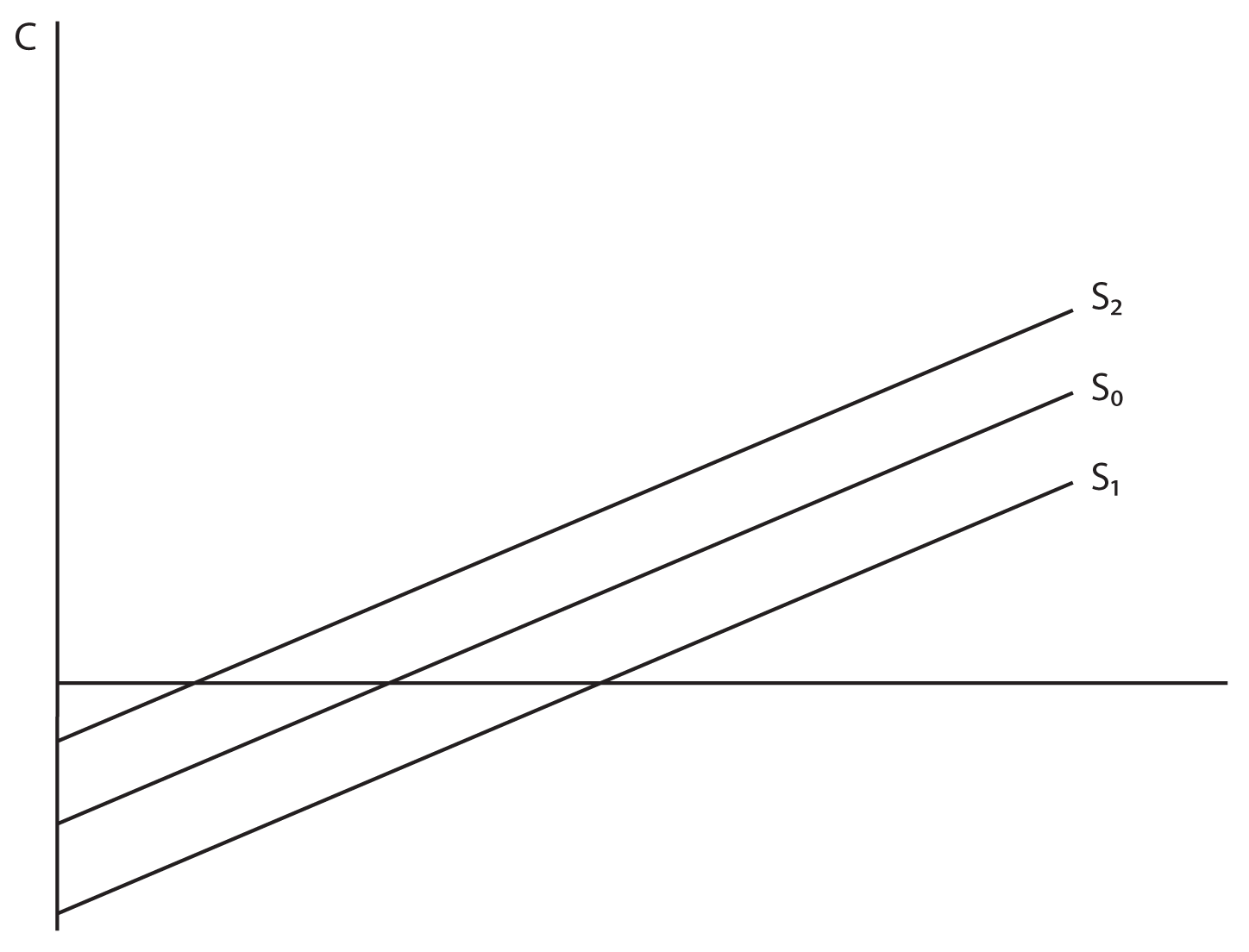

Some of the Non-Income Determinants of Consumption and Savings

Notice that when nosotros graph the Consumption Part, Consumption is measured on the vertical axis and dispensable income is measured on the horizontal axis. As disposable income goes up, consumption goes upwards and this is shown by movement along a single consumption function. But there are other things that influence consumption besides disposable income. What if ane of these non-income determinants of consumption changes? Since they are not measured on either centrality, we should annotation that a alter in a non-income determinant of consumption will shift the entire consumption function not just move yous along a stock-still consumption function. Permit'southward wait at several of these non-income determinants of consumption and savings:

- Wealth—In economics wealth and income are two divide variables. A simple case will illustrate the divergence. Let's say that you have a job earning $l,000 a year. If your not bad aunt Maude dies and leaves you $100,000 in an inheritance, your income is still $50,000 a year, only your wealth has just gone up. The same could be said about sudden increases in the value of a piece of art that you lot own, the discovery of oil on your property, or increases in the value of your stock portfolio. None of these occurrences increases your income, but they all increase your wealth. An increment in wealth will increase your consumption even at the same income level, and can exist illustrated by an upward shift in both the Consumption Part and the Savings Function. Apparently, a decrease in wealth will have the reverse effect.

- Expectations—In that location are times when consumers conform their spending, based not on their actual income but rather on their expectations of future changes in their income. Changes in expectations will cause a shift in the curve, because consumption has changed without an actual run a risk in income. For instance, if you lot think your income is going to become up in the future, you lot may consume more than today. Not that we advise this every bit a wise course of action, simply it has been observed that some college seniors start to spend more in one case they have secured a job, fifty-fifty though that job (and its attendant income) volition non get-go for a month or ii. This beliefs would exist illustrated by an upward shift in the consumption function showing that your consumption has increased even though your bodily disposable income has non. Likewise, if for some reason you were pessimistic about your hereafter income (rumors floating around the company that layoffs were eminent) you might subtract your consumption, even though your actual current income had non inverse.

- Consumer Indebtedness—Consumers adjust their consumption to levels of indebtedness as well. We observe in the amass economy that when indebtedness goes up, consumption falls and savings rise. There is a level of debt beyond which consumers feel uncomfortable with additional spending. Fifty-fifty if income has stayed the same, if likewise much debt accumulates, consumers will commencement to spend less and pay off debt. This is illustrated by a downwards shift in the Consumption Function and an upward shift in the Savings Function (call back that paying off debt is the aforementioned thing as increasing savings). The opposite is too true. At low levels of debt people will swallow more than and salve less.

You can likely call up of other factors that are unrelated to income that could shift the Consumption and Savings Functions. In general, annihilation that influences consumption or savings that is Non dispensable income will shift the Functions upward or downward. Whatever alter in dispensable income will move you along the Functions.

Return to the course in I-Learn and complete the action that corresponds with this material.

Department 02: The Interest Rate — Investment Relationship

The 2nd component of amass expenditures that plays a significant role in our economy is Investment. Remember from our lesson on National Income Accounting that investment only occurs when real capital is created. Investment is such an important part of our economy because it affects both brusque-run aggregate demand and long-run economical growth. Investment is a component of aggregate expenditures, then when a company buys new equipment or builds a new plant/office building, it has an immediate short-run affect on the economy. The dollars spent on the investment have the immediate impact of increasing spending in the current time period. But because of the nature of investment, it has a long-term impact on the economy also. If a company buys a new auto, that machine is going to operate, keep to produce, and will have an bear on on the productive chapters of the economy for years to come up. This is in contrast to consumption purchases that do non have the same affect. If y'all buy and consume an apple today, that apple does not continue to provide consumption benefits into the future.

Expected Rate of Render

An important question in the report of investment is, "Why practice firms invest?" Investment is guided past the turn a profit motive—firms invest expecting a return on their investment. Before the investment takes identify, firms only know their expected rate of return. Therefore, investment almost e'er involves some risk.

Consider the post-obit scenario. Permit's say that you are an old-fashioned printer who is all the same setting blazon past hand. You know that your equipment is slow and outdated. You also know that investing in modern computerized printing presses will yield a positive return for your concern, merely that they will be very expensive. A new press will price you $500,000 and you practice non take $500,000 sitting in your drawer at dwelling house. In order to undertake the investment in new equipment, you will have to borrow the money. Let's say you have estimated the expected charge per unit of return on the investment in new equipment to be 5.v%. Should you infringe the money and buy the new equipment? What will influence you decision?

The fundamental variable that will aid you to decide whether the investment makes sense for you is the existent interest rate that you volition have to pay on the loan. If the expected rate of return in greater than the real involvement rate, the investment makes sense. If information technology is not, then the investment volition not exist profitable. If you become to the bank and the broker says that he is going to accuse you 6% involvement on the loan, you would expect to lose money on the investment. You cannot pay 6% on the loan if you just expect to earn v.five% on the investment. If, however, the depository financial institution charges you iv% interest on the loan, then the investment tin can be undertaken profitably.

The real interest rate determines the level of investment, fifty-fifty if you lot do not take to borrow the money to buy the equipment. What if you did accept $500,000 sitting in your drawer, and you lot had to decide whether to buy machines that would yield an expected charge per unit of render for your company of five.5%. If the real involvement rate at the depository financial institution is vi%, yous would not buy the machines. You would instead put the money in the bank and earn 6%. If the interest rate at the banking company were iv%, you would purchase the machines because they volition yield a higher return than the next all-time culling available to you.

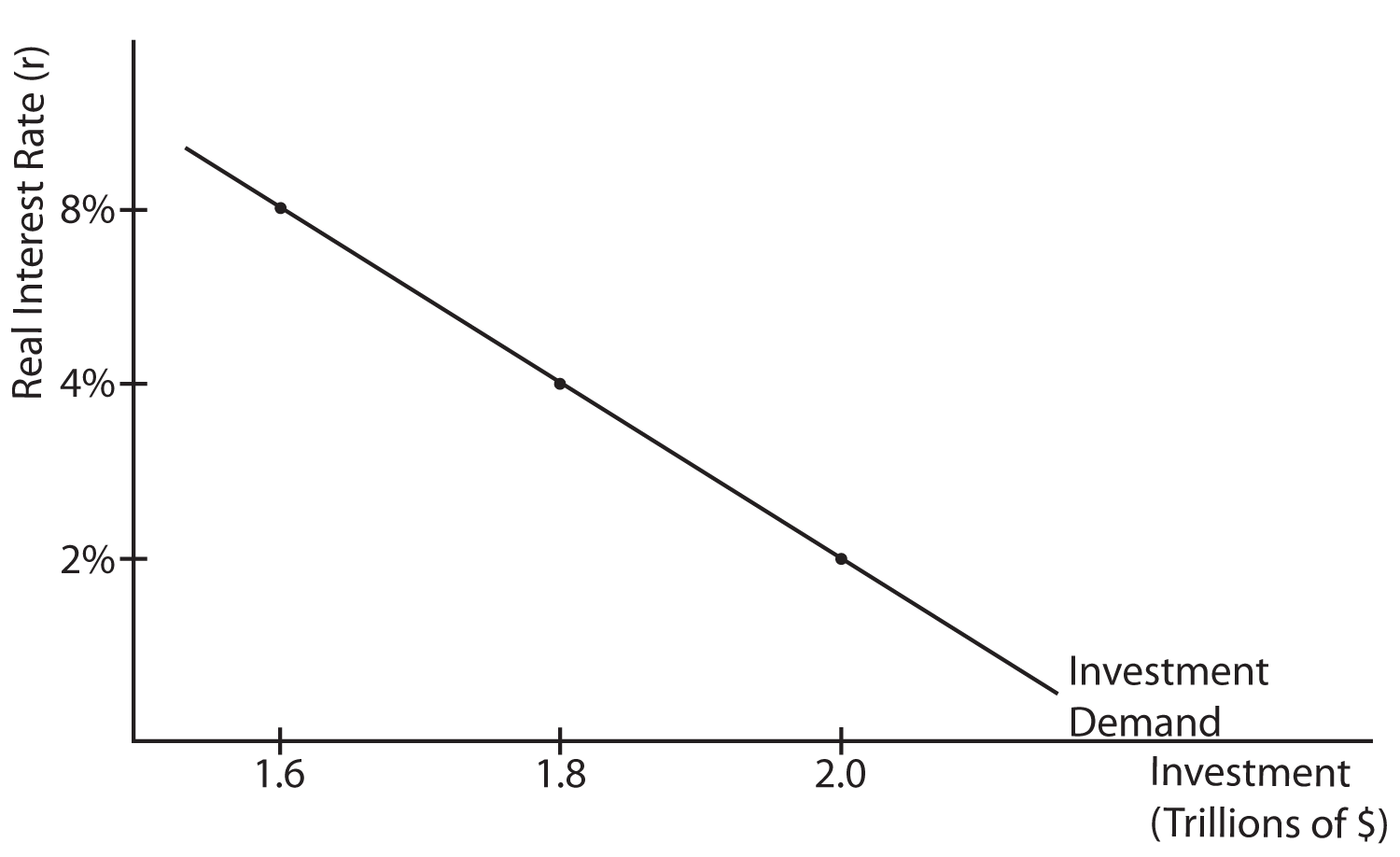

The Investment Demand Curve

As was illustrated in the example above, the existent rate of interest has an impact on determining which investments can be undertaken profitably and which cannot. The higher the existent rate of interest, the fewer investment opportunities will be profitable. When the real charge per unit of interest is at 8%, only those investments that have an expected rate of render higher than viii% will be undertaken. If the interest charge per unit is iv%, all investments with an expected rate of return higher than 4% will be undertaken. There are more investments with an expected rate of return higher than 4% than at that place are with an expected rate of return higher than 8%, so there is more than investment at a lower rather than a college real rate of involvement. This changed relationship between the real rate of interest and the level of investment is illustrated in the Investment Need Curve shown beneath.

What Might Cause Shifts in the Investment Demand Curve?

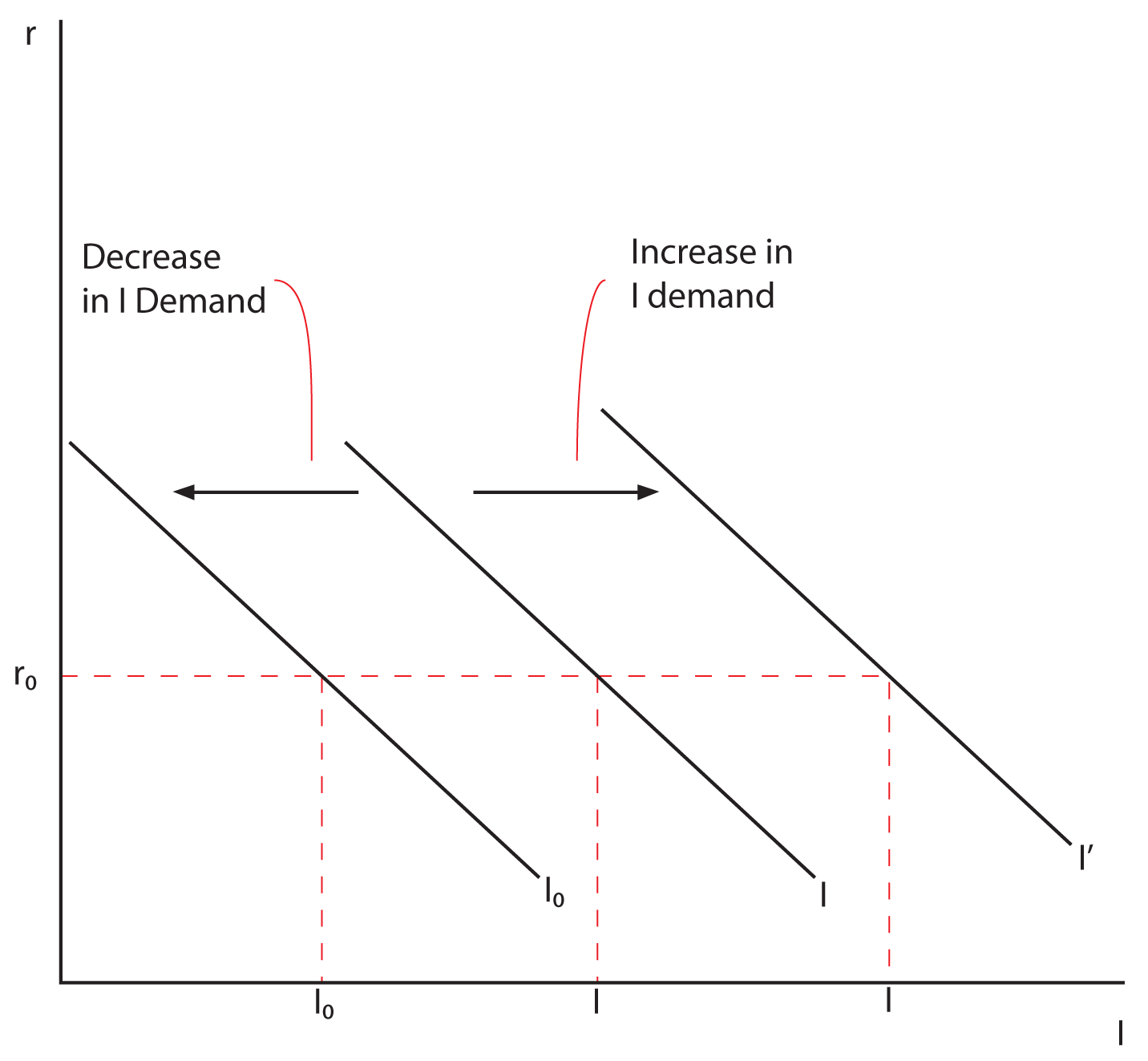

As with the Consumption Function, at that place are factors that will shift the entire Investment Demand Curve. These are non-interest charge per unit determinants of Investment. While there are many things that tin can influence the level of investment in the economy other than the real interest charge per unit, we will talk over only three.

- Business Taxes—The government can influence the level of investment by the tax construction they impose on businesses. When the government gives taxation incentives for investing in new upper-case letter (such equally allowing businesses to depreciate new uppercase at a faster rate, or giving tax credits for new "green" investments), this encourages additional investment at all levels of the real involvement charge per unit and shifts the Investment Need Curve to the right. For example, in the graph beneath, if the existent involvement charge per unit is r o, investment is at I o, the government gives revenue enhancement incentives that encourage investment, then fifty-fifty at the same interest rate we might expect the level of investment to increment to I'. If the authorities withdraws these taxation incentives, then the Investment Need Curve shifts to the left.

- Changes in Technology—A business will be more than likely to increase investment in an industry where technology is changing than in an industry with a more fixed technology. Businesses recognize the demand to keep up with competitors' utilization of modernistic technology. At whatsoever given level of the existent interest rate you would expect Investment Demand to be higher the more technology is advancing.

- Stock of Capital Goods on Hand—Businesses that already have a significant stock of majuscule on hand are less likely to invest in boosted uppercase. For example, a company that has excess office space or idle plants is non as probable to invest in additional capital letter as a business that is operating at or beyond chapters. At any given level of the existent interest charge per unit, you would await more investment by a firm that is short on capital goods than by a firm that has an adequate stock of capital on hand.

Source: https://courses.byui.edu/ECON_151/Presentations/Lesson_06.htm

Posted by: johnsonaceis1957.blogspot.com

0 Response to "Which Of The Following Variables Do Not Change Autonomous Consumption?"

Post a Comment